Don’t get me wrong, I am a huge fan of cloud based accounting software. However, there are some risks and disadvantages, some of which I have learned through experience. I will discuss them in detail and show you how to mitigate them.

Don’t get me wrong, I am a huge fan of cloud based accounting software. However, there are some risks and disadvantages, some of which I have learned through experience. I will discuss them in detail and show you how to mitigate them.

1) Database conversion problems

Right out of the starting blocks, this is a significant one and can cause a lot of headaches during what should be your journey into a life of easier accounting.

There are a number of factors that can impact the complexity of your data migration, including:

- Single currency or multi currency

- Number of bank accounts

- Timing of the database conversion (financial year-end or at the end of sales tax/VAT cycle)

- Selling inventory vs selling a service

- How clean your Bank, Accounts Receivables and Accounts Payable reconciliations are at conversion point.

- How many years of historical data you want to include

- a change in financial year-end in any of the years included in the data conversion

It is important to speak to your cloud software company before the conversion starts, and that you understand exactly what your responsibilities are regarding the accuracy of the data post conversion. Some companies will require you to check everything including the allocation VAT (sales tax) transactions after the conversion. Usually the final responsibility rests with you as the customer, and you need to know what to checks to perform after the conversion.

You may be offered a free or very cheap conversion as incentive to sign up for the software. Some providers, like QuickBooks online don’t allow journal imports without purchasing an add-on on, so you might be forced to use their conversion service.

Xero accounting may offer to pay for the use of the 3rd party like cloudconvert.co.za, or you can search for a Xero Partner with the Migration certification (like me!).

In my experience, the biggest challenge arises from the use of multiple currencies. Cloud accounting software automatically pulls the exchange rates from their preferred 3rd party source. Even the smallest decimal variances between the rate you used and the rate of the software will result in a difference on your gain/loss on foreign exchange movements.

Another big challenge is filing the first VAT (sales tax) return after conversion. It is worth your time to review your detailed tax reports and ensure that your are not claiming/declaring too much or too little, and also that the tax status of the transactions are correctly reflected in your new cloud software.

If you have opted not to convert prior financial years of accounting data, make sure that your desktop software version is still working and accessible without upgrades. Make multiple backups and consider exporting the complete general ledger for every financial year-end into an Excel Data Table. If you don’t know how to do this, leave me a comment at the end of this post or contact me.

2) Security and data loss risks

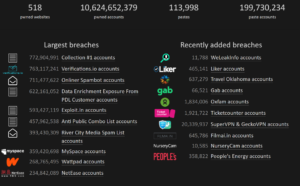

Password security and potential hacking becomes a new risk, as for any other website where you enter a password. Even big companies like Dropbox and LinkedIn have been victims of hacks resulting in leaked passwords.

It is important that you and your staff use strong, unique passwords. A good antivirus software to protect against malware is also important. Make sure you choose a reputable cloud accounting software provider with a sufficient level of data protection and password protection against hacking.

Also, read the fine print with regard to data loss and make sure you understand it. Don’t hesitate to ask your account manager or sales rep if you have concerns about security and data protection.

3) No internet, or poor quality connection

It’s pretty straight forward, no internet connection means no access to your accounting data. This risk is mitigated by the fact that most mobile phones can act as mobile hotspots to provide Internet access to your laptop. However, if you find your self i a remote area with no connection, you won’t be able to access to accounting records.

Working on a slow connection, for example an airport WiFi connection, can also be very frustrating. It can be very frustrating when you are in the middle of a complex journal entry and you are faced with a frozen page.

4) Finding & selecting the best apps

Similar to the apps you install on your mobile devices, app developers design apps for use with cloud based accounting software. You data is protected by the API of your accounting software, which determines what the app can and cannot do.

The number of apps available is constantly increasing. This can make it chossing the right app overwhelming and quite a difficult task. Reading reviews can help, but remember that every business is unique. Finding the best app will take some research to ensure that you find an app that has a proven track record, good support and all the features that your business require.

Another potential headache is when the app does not want to interact with software. I have personally experiences this problem. The app support claimed the problem was with the accounting software, while the accounting software support simply stated that they help issues arising from 3rd party apps.

The Best advice I can give is to speak your adviser or client manager and try to find out what other businesses in your industry type is using.

5) Increasing costs from your software and apps

Cloud based accounting software is charged on a monthly subscription basis. Some software providers will charge you extra once you exceed a certain number of users, while others don’t. It is important to establish that before you sign up.

You will always pay more if you need a multi currency version, due to the added complexity. If you started with a single currency version and your business starts to operate in other currencies, you will have to upgrade.

There is also the risk of price increases for your software. For example QuickBooks online has increased their pricing since the initial launch. Sage One South Africa have also increased their prices after launching their product.

The same risks apply to use of apps or add-on’s. Most invoice processing apps charge based on your average use of the app. Sometimes the pricing simply changes as the app company grows, for example Receiptbank who changed their pricing in 2019, resulting in users of the basic platform facing the choice of losing features or upgrading.

6) Regional limitations for multinational access

If your company is multinational and operates in various countries, you would be looking to utilise a single software across all subsidiaries and branches. You might be frustrated to learn that not all cloud accounting software companies operate the same across countries.

For example Sage One in the UK is a cloud version of Sage50 desktop, which is a completely different product to Sage One South Africa. QuickBooks Online is more uniform product, but your companies fall into separate regions, you cannot access them from the same portal, and your adviser and/or account won’t be able to either, it would require separate registrations. To my knowledge Xero, is the only true international cloud accounting software.

7) No more backup and restore

On desktop software, it can be quite useful to make time stamped backups, for example just before you run a VAT (sales tax) return or you are trying something significant like a large excel journal import. Cloud accounting software does keep detailed audit logs of every users actions, but it would more time-consuming to find and undo the errors than simply restoring the last good backup available.

Conclusion

These risk and disadvantages are easily outweighed by the advantages of cloud accounting software, however it is important that you are aware of them and mitigate them before you jump into the switching process.

If you are concerned about any of these or have questions, please post them in the comments section below.

Alternatively, if you need more detailed assistance, head over the contact page by clicking here.