The worldwide impact of the Corona Virus (COVID-19) demonstrated the importance of being able to access your accounting records remotely. And that certainly is one of the main and obvious benefits of cloud based accounting software.

However, that is just one of the many advantages of taking your accounting to the cloud:

1) Accessible accounting records from multiple locations and from multiple devices

As long as you have access to a computer with internet access, you can log in via your web  browser and access your accounting software. You can use apps from your mobile device, for example to issue a quote while you are at a client.

browser and access your accounting software. You can use apps from your mobile device, for example to issue a quote while you are at a client.

If your business has multiple locations, staff at all locations can access the same data in real time.

As explained in detail below in point 3, should anything happen to your desktop or laptop, you can access your accounting software from any other device with an internet connection, resulting in minimal down time and no data loss.

Another bonus is that it eliminates compatibility issues between Windows PC’s or Apple Mac’s. You can easily switch between browsers, for example Chrome, Internet Explorer, Firefox or Microsoft Edge. As long as you have access to the internet, you will have access to your accounting software.

2) Automatic backups prevent data loss/remove risk

Most small businesses do not perform regular backups and are unaware of the risks faced by losing their data.

Important questions to ask regarding your desktop/server backups:

- How often do your backup your accounting data?

- How often are the backups moved offsite?

- If you outsource backups to your IT company, have your checked with them regarding the above 2 points?

- How often are the backups verified and tested by performing a successful data restore from them?

- What is your maximum number of days of data loss you are exposed to, should your server/desktop in the office get stolen or damaged today?

- What would happen to your accounting data if your desktop/server is infected by a virus today?

Cloud accounting software takes care of all these questions. Your accounting data is instantly and continuously backed up as your work and make changes.

If you are using a reputable cloud accounting service provider (contact me if you are unsure), you can rest assured that these companies spend much more time and money on keeping your data safe that you ever would as an individual. Data is usually mirrored on 2 to 3 servers in separate locations, sometimes even countries.

When you think about it, if the data backup fails, their whole business model fails, so you can rest assured they will have that covered.

3) Protecting your data against computer viruses

Despite modern anti-virus software, infections still do happen. Simply forgetting to set your software to auto update can leave your computer exposed. If you have a server setup in your office, any one of the connected terminals or visitor laptops can be infected and spread the virus to the server and the rest of the network.

With a cloud based software program, your accounting data remains unaffected by a potential virus on your computer. Your interaction with your accounting data is via a web portal and therefore it is never exposed any virus or malware your desktop/server.

In the unfortunate event of a virus infection, access to your accounting system is delayed only by the time it takes to clear the virus, or access an alternative computer (see point 1 above).

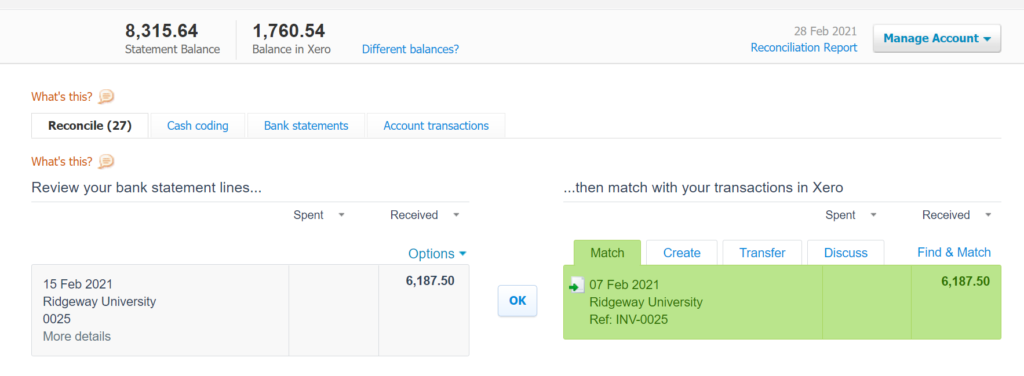

4) Automatic bank feeds lead to improved speed and accuracy, plus improved fraud prevention controls

By activating automated bank feeds in your cloud accounting software, your no longer need a cash book module as found in many traditional desktop software. The bank feeds collect the data straight from the online banking system, and bank reconciling and matching is done directly from the bank feeds. This reduces the amount of time to complete and eliminates processing errors (if done correctly).

Sometimes, importing your bank transactions via CSV files might be required, in cases where a bank feed is not available. However, automatic bank feeds are still the most secure option. It should be a key point in your choice of software.

CSV files are easily edited. If you are converting bank statements with a PDF to CSV conversion service like ReceiptBank or AutoEntry, remember that PDF’s can also be edited. Even if you upload a CSV bank file which you have submitted yourself for conversion from PDF, you still need to ensure the integrity of the PDF you have used for conversion.

Automatic bank feeds solve this potential problem by connecting directly to your bank. By segregating duties and setting up proper user rights, the potential gaps for manipulating bank transactions are minimised.

5) Improved credit control & cash flow

Invoices can be emailed instantly to your customers as soon as they are created in your cloud accounting software. You can set automated follow up messages to email your customers once the invoices become overdue. This saves a lot of time with customers who simply forgot to pay, freeing up time for you or your staff to focus on those customers with disputes, queries, etc.

You can integrate your accounting software with online payment methods, depending on your choice of software. Your invoice can include a ‘pay now’ option for customers to click on. Research has proven that this can significantly reduce the time on the payment cycle of customer invoices, sometimes by as much as 50%.

6) As a business owner, you have real time access to your accounting information which leads to better management decisions

With cloud based accounting, your no longer have to wait for your accountant to send your management reports. Your information is no longer stored on their desktop machine, in their office. You have real time access to all your information, and everything is easily shared with your accountant. You now have the flexibility to decide how much of your accounting function you want to do in house and how much you want to outsource to an accountant. Either way, at any time you can log in and see the same information as your accountant, and asses for yourself how far along your month end procedures have progressed.

You can also reduce your audit time and cost by allowing your auditor view only access to your accounting information.

7) Availability of apps lead to improved efficiency and functionality

Similar to apps available on your mobile device, third parties can develop apps to interact with your cloud accounting software.

Invoice processing apps like ReceiptBank and AutoEntry significantly reduces time and errors in processing expense receipts and invoices. The apps capture basic information including amounts, date, invoice number, tax amount, etc. You can review and publish the invoice from the apps platform, which will then publish (or post) it to you accounting software, with a copy of the invoice attached to the transaction. These apps also serve as digital archiving (see point 8 below)

Another example is inventory management apps, like Dear inventory. If you cloud based accounting software does not have a suitable inventory model available, you can use a third party app that better suits your type of business.

There are many other options, like POS and hospitality specific apps.

If your industry is very specialised, you could also approach a software developer to design a custom-made app for your business. You might think that this would be too expensive. In my experience, it is often more expensive in the long term to upgrade to a more sophisticated software package, which will often include functions not used for your specific business. Therefore I would always explore this option for specialised industries.

8) Going paperless reduces the time, cost and space required with physical invoice filing

Cloud accounting software acts as a digital storage for invoices and expense receipts. Utilising invoice processing apps as mentioned above, eliminates the need for printing, filing and storing hard copies of invoices and expense receipts. The entries in your accounting records will automatically include a PDF copy of the related invoices for future reference.

Apps like ReceiptBank and AutoEntry comes with a handy mobile app, which allows expense receipts and slips to be scanned immediately from a mobile device. The details can be edited later on the web portal and allocated to expense reports. The receipts can be discarded as soon as it has been scanned, so no need to worry about losing them or forgetting to submit an expense.

Drafting up and stapling a bunch of receipts to the printout is also no longer necessary. And no need to worry about the fact that most slips tend to fade over a relatively short period, which is great for audit purposes and it’s good for the users as well as it relieves them of the burden of keeping copies of their expense receipts.

9) Automatic software updates

Desktop software requires a license to use. When new updates are released, you are faced with the choice of paying for the version, face the risk of having outdated software which will not be supported at some time in the future.

Cloud based accounting software is always up to date and most providers charge monthly, so you know what to expect in terms of costs and won’t receive any unexpected costs for upgrading.

10) Enhanced reporting

Reporting is enhanced with cloud based accounting whereby your can easily save templates of your report and their reports are customisable in a much easier way than traditional report writing models which is found in desktop applications the reports can be set to email on a daily basis or other weekly or monthly basis the reports can easily be shared across users and in the case of

11) Free database conversion options

Most providers of cloud accounting software will offer to do the database conversion for free or at minimal cost.

Conclusion

Clearly there many benefits to switching your account software to the cloud. As with all things in live, there are some factors to consider. You can read a full discussion on the risks and disadvantages of cloud accounting software by clicking here, where I will also discuss how to mitigate there risks.

If you have questions on what I have discussed here, please drop a comment below and will respond as soon as possible. Alternatively, reach out to me directly via the Contact page.